Canadian Families Spent More on Taxes than on Necessities in 2015

VANCOUVER: Most people are familiar with the old adage – “nothing is as certain as death and taxes”! Now, a study finds that not only are taxes certain but, thy cost average Canadians more than what they shell out on life’s necessities.

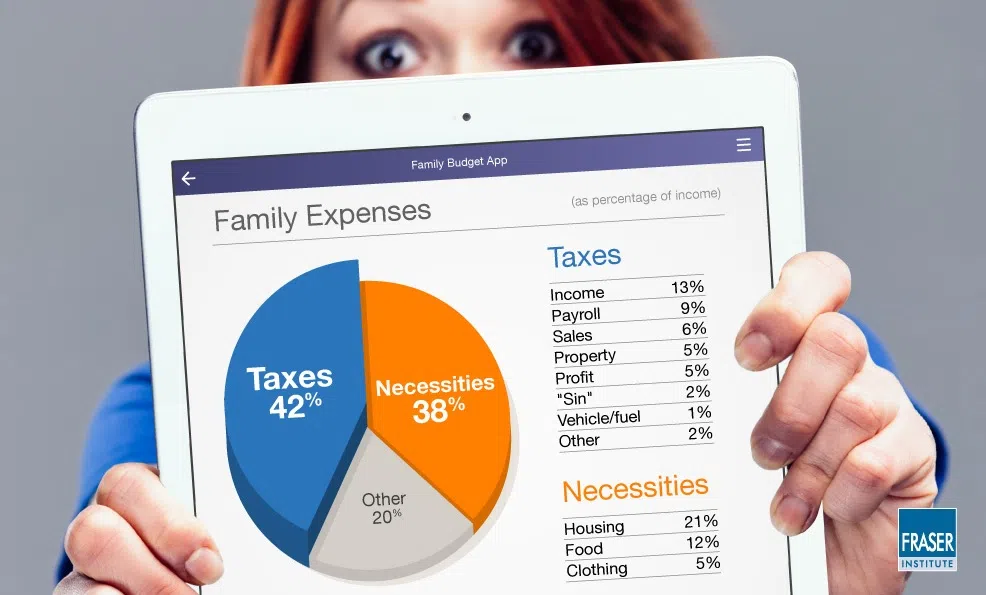

Vancouver-based think-tank, the Fraser Institute, has calculated the average Canadian family spent 42.4 per cent of its cash income on taxes in 2015.

That evaluation includes income taxes, property taxes, sales taxes and taxes on business, which are passed on to the consumer in the price of goods and services.

That works out to $34,154 in taxes on the average family income, which it estimates at $80,593.

The majority of that amount goes to government income tax and accounts for $10,616. The next biggest category is $7,160 in payroll and health taxes – $4,973 in sales taxes and property taxes of $3,832.

An other category includes taxes on profits, liquor or tobacco, fuel, natural resources and import duties totalling $7,573.

By comparison, the average family spent $30,293 — or 37.6 per cent of its total cash income — on housing, food and clothing.