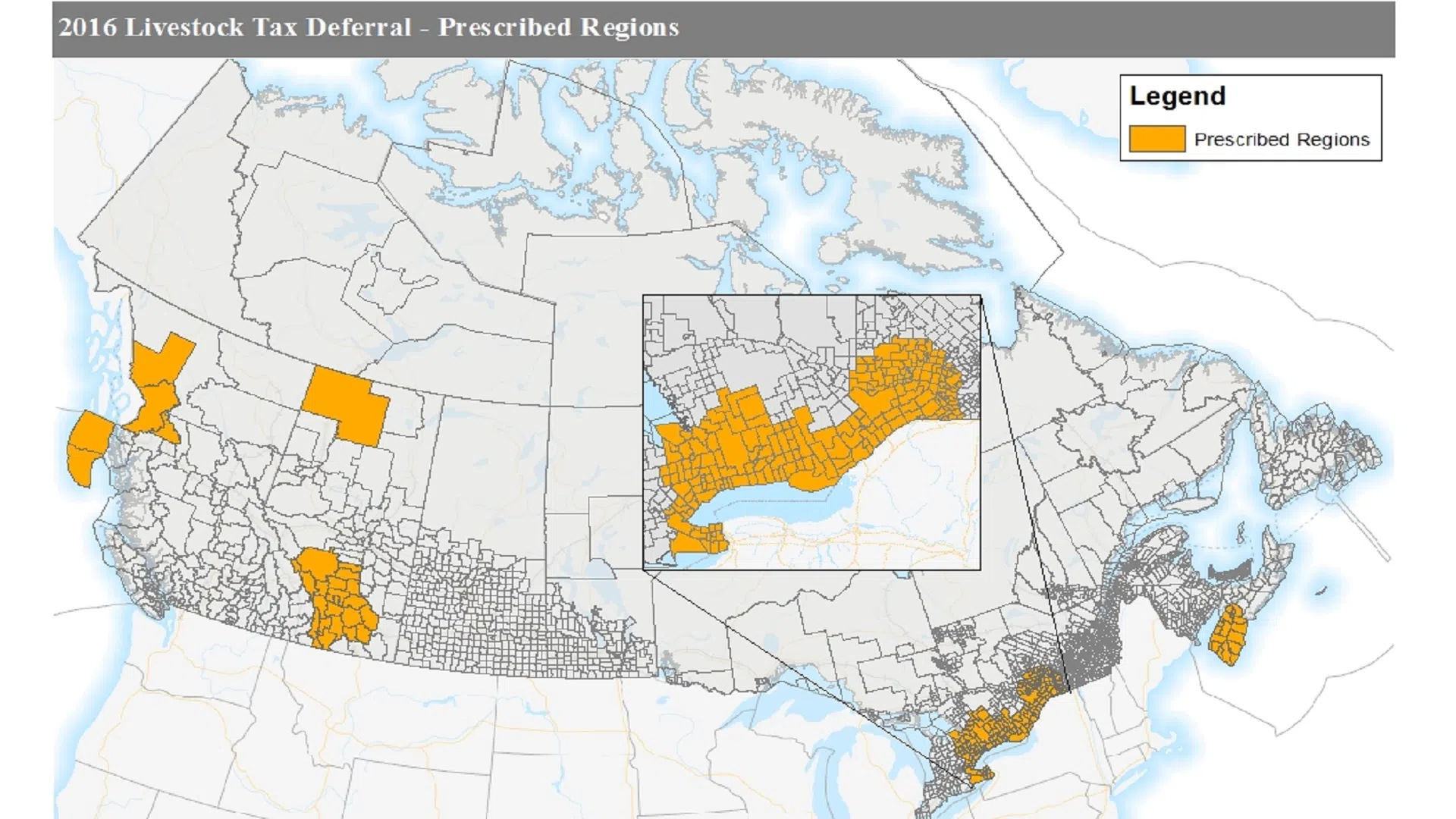

Final list of 2016 designated Livestock Tax Deferral regions

OTTAWA – Agriculture and Agri-Food Canada has issued a final list of designated regions where livestock tax deferral has been authorized for 2016. The deferral is being allowed because of drought conditions in B-C, Alberta, Ontario, Quebec and Nova Scotia.

The provision allows producers in designated drought regions who were facing feed shortages, to defer a portion of their sale proceeds of breeding livestock to the next year. The cost of replacing the animals in the next year offsets the deferred income, which reduces the tax burden on the original sale.

Eligible producers can request the tax deferral when filing their 2016 income tax returns, or if they have already filed, submit an adjustment request directly to the Canada Revenue Agency.

Information on the Livestock Tax Deferral provisions can be found at Agriculture and Agri-Food Canada and the 2016 Final List of Designated Regions