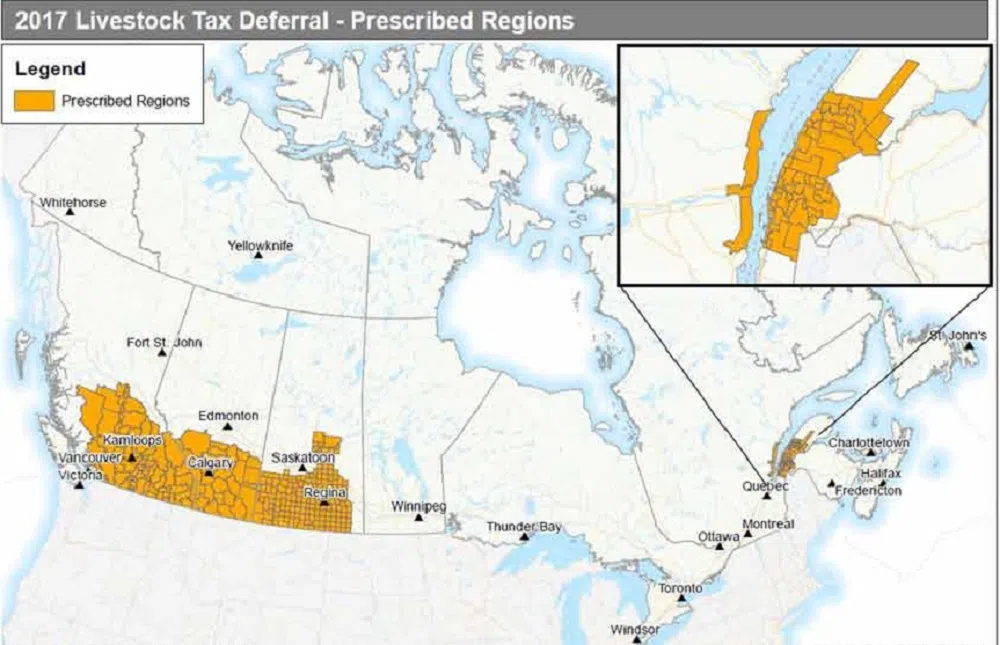

Designated regions for 2017 Livestock Tax Deferral finalized

OTTAWA – Agriculture and Agri-Food Canada has released the final list of designated regions where Livestock Tax Deferral has been authorized for 2017 due to drought, flood or excess moisture conditions.

The initial list of designated regions was announced on November 6th. However, additional regions in B.C. and Saskatchewan were added after further analysis found areas with forage shortfalls.

Low moisture levels accounted for significant shortfalls across the southern portion of B.C., Alberta and Saskatchewan and would have required ranchers to reduce their breeding herd to stretch their feed supplies.

Provisions for livestock tax deferral allows producers to defer a portion of their 2017 sale proceeds of breeding livestock. The 2018 cost of replacing the animals will offset the deferred income and reduce the tax burden associated with the original sale.

Only those producers within the designated areas are eligible for the tax referral and they need to request it when filing income tax returns for 2017.

Federal Agriculture minister, Lawrence MacAulay, noted the deferral woul be crucial of many producers,

“This tax deferral will help producers manage the impacts of the adverse weather, while focussing on rebuilding their herds in the coming year. This will help farmers keep their businesses strong, while growing the economy and strengthening the middle class.”

More information on business risk mangement programs can be found at Growing Forward 2 and at Drought Watch.