Livestock Tax Deferral areas expanded for 2018

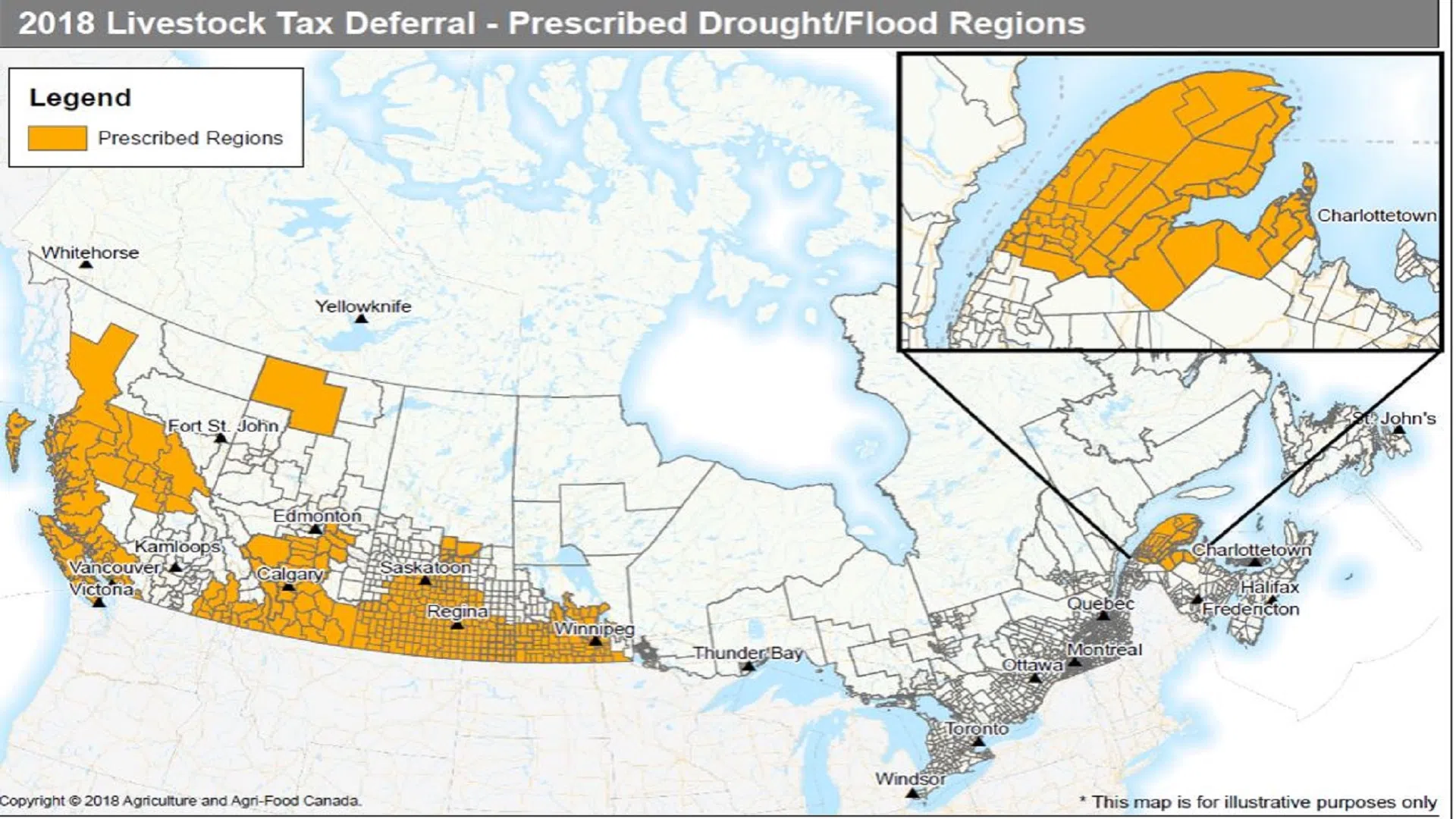

OTTAWA –– The federal government has released an additional list of regions, where Livestock Tax Deferral has been authorized for 2018 because of drought.

An initial list of affected regions in British Columbia, Alberta, Saskatchewan, Manitoba, and Quebec for livestock tax deferral purposes was issued on September 14, of 2018.

The livestock tax deferral provision allows producers in specific drought or excess moisture regions to defer a portion of their 2018 sale proceeds of breeding livestock until 2019 to help replenish the herd. The cost of replacing the animals in 2019 will offset the deferred income, thereby reducing the tax burden associated with the original sale.

Eligibility for the tax deferral is limited to those producers located inside the prescribed areas. Producers in those regions can request the tax deferral when filing their 2018 income tax returns.