Initial Regions set for 2019 Livestock Tax Deferral Provision

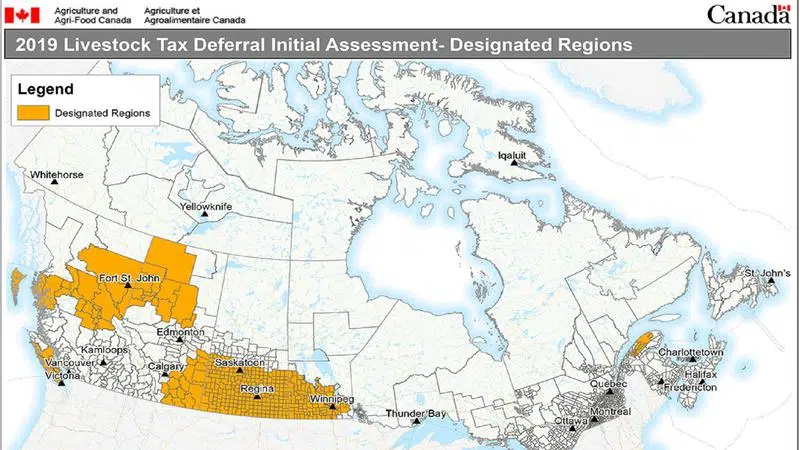

OTTAWA — Agriculture and Agri-Food Canada has released an initial list of where livestock tax deferral has been authorized for 2019 due to extreme weather conditions.

Preliminary analysis indicates livestock producers in the four Western provinces and an area of Quebec are dealing with significant forage shortages, brought on by drought conditions, and producers may need to reduce their breeding herd in order to manage feed supplies.

Additional regions may be added to the list, pending further consultations.

Livestock tax deferral allows producers in areas impacted by drought, flood or excess moisture to defer a portion of their 2019 sale proceeds of breeding livestock until 2020 to help replenish the herd. The cost of replacing the animals in 2020 will offset the deferred income, thereby reducing the tax burden associated with the original sale.