Federal government finalizes list of regions entitled to Livestock Tax Deferral

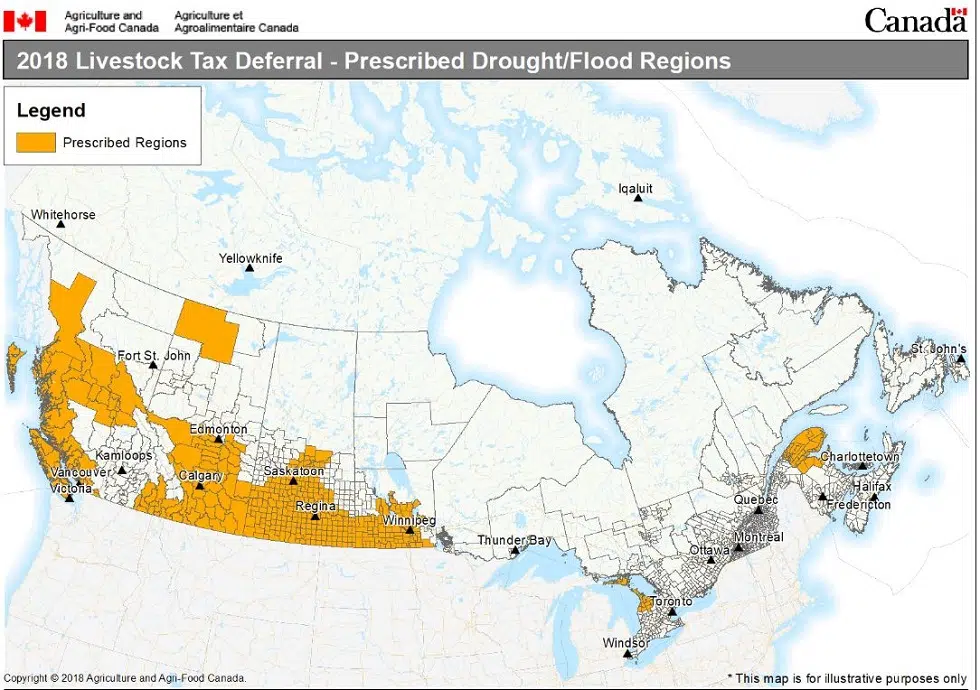

OTTAWA — the federal governemnt has released a finalized list of designated regions authorized for the 2018 livestock tax defferal. Most of the areas are in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec and New Brunswick, due to drought conditions.

Reduced moisture levels in some areas in 2018, resulted in significant forage shortages for livestock. In turn, that resulted in producers having to reduce their breeding herd as a feed management strategy.

The tax deferral will allow producers in the designated regions, to defer a portion of their 2018 sale proceeds on breeding livestock until 2019, in order to rebuild their herds. The cost of replacing the animals in 2019 will offset the deferred income, thereby reducing the tax burden associated with the original sale.

The government announced an initial list of prescribed regions foe the tax deferral last September, and then updated it on October 31. However, ongoing analysis indicated the designated regions needed to be expanded, which provided the finalized document. Producers in those regions should request the tax deferral when filing their 2018 income tax returns.

In addition to the livestock tax deferral provision, producers have access to assistance through existing Canadian Agricultural Partnership Business Risk Management programs, which include Agri-Insurance, Agri-Stability and Agri-Invest